Why a Mileage Tracker App is Crucial for Creating a Effortless Mileage Log

Why a Mileage Tracker App is Crucial for Creating a Effortless Mileage Log

Blog Article

Maximize Your Tax Obligation Reductions With a Simple and Effective Mileage Tracker

In the realm of tax reductions, tracking your gas mileage can be an often-overlooked yet essential task for maximizing your monetary benefits. A well-kept mileage log not only ensures conformity with IRS needs yet also enhances your capability to confirm overhead. Picking the ideal gas mileage tracking tool is crucial, as it can simplify the procedure and improve accuracy. However, lots of individuals fail to totally leverage this opportunity, resulting in potential lost financial savings. Comprehending the subtleties of efficient mileage tracking might expose techniques that could dramatically impact your tax obligation situation.

Importance of Mileage Monitoring

Tracking gas mileage is essential for anyone looking for to maximize their tax obligation deductions. Exact gas mileage monitoring not only makes sure conformity with internal revenue service laws yet likewise permits taxpayers to gain from deductions connected to business-related traveling. For independent individuals and local business owner, these reductions can significantly lower gross income, therefore decreasing overall tax obligation obligation.

In addition, maintaining a detailed record of gas mileage helps compare individual and business-related trips, which is crucial for corroborating cases during tax audits. The internal revenue service needs particular documentation, consisting of the day, location, objective, and miles driven for each journey. Without thorough documents, taxpayers run the risk of shedding important reductions or facing penalties.

Additionally, effective gas mileage monitoring can highlight trends in travel expenditures, helping in much better economic planning. By examining these patterns, people and companies can recognize possibilities to enhance traveling routes, minimize prices, and boost operational effectiveness.

Picking the Right Mileage Tracker

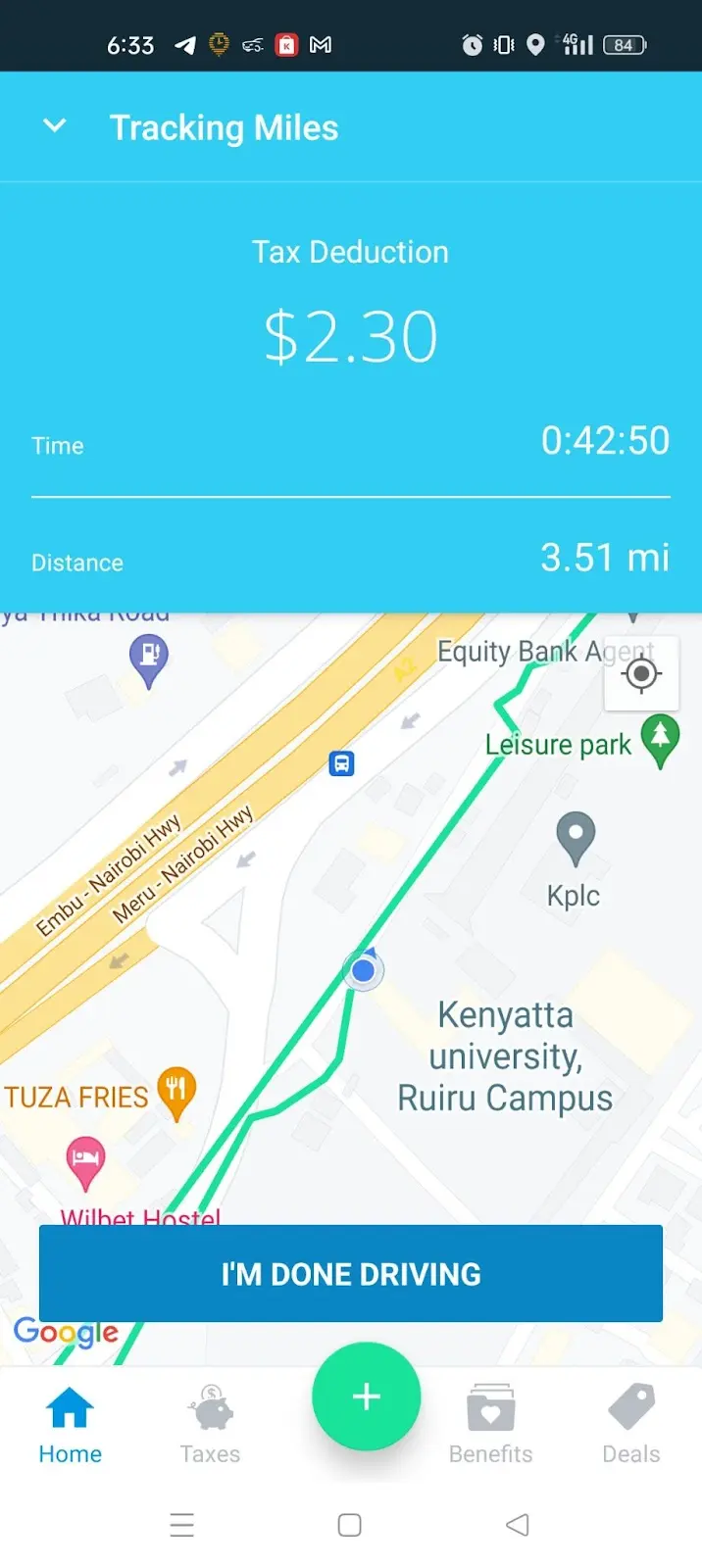

When selecting a mileage tracker, it is important to think about various features and capabilities that straighten with your details demands (best mileage tracker app). The first aspect to assess is the method of tracking-- whether you favor a mobile app, a GPS gadget, or a hands-on log. Mobile applications often provide convenience and real-time tracking, while GPS devices can offer more precision in range dimensions

Next, analyze the integration capacities of the tracker. An excellent gas mileage tracker need to flawlessly integrate with accounting software or tax preparation tools, permitting for uncomplicated information transfer and reporting. Look for features such as automated tracking, which reduces the demand for hands-on entrances, and categorization choices to compare business and personal journeys.

Exactly How to Track Your Gas Mileage

Selecting a suitable mileage tracker sets the foundation for efficient gas mileage management. To precisely track your mileage, begin by figuring out the function of your travels, whether they are for organization, charitable tasks, or clinical factors. This clarity will certainly assist you classify your journeys and guarantee you record all pertinent data.

Next, constantly log your gas mileage. For hand-operated entrances, record the beginning and ending odometer analyses, along with the date, objective, and route of each journey.

It's also necessary Look At This to on a regular basis evaluate your entrances for precision and completeness. Set a routine, such as regular or month-to-month, to consolidate your documents. This technique aids protect against disparities and ensures you do not forget any kind of insurance deductible gas mileage.

Finally, back up your documents. Whether electronic or paper-based, maintaining backups safeguards against data loss and helps with easy access throughout tax prep work. By vigilantly tracking your mileage and maintaining organized documents, you will certainly prepare for maximizing your possible tax reductions.

Making Best Use Of Reductions With Accurate Records

Precise record-keeping is essential for maximizing your tax deductions related to mileage. When you keep in-depth and accurate documents of your business-related driving, you produce a robust structure for claiming deductions that may dramatically decrease your taxable earnings. best mileage tracker app. The internal revenue service requires that you record the date, destination, function, and miles driven for each journey. Enough detail not just validates your insurance claims yet likewise gives defense i thought about this in instance of an audit.

Utilizing a mileage tracker can enhance this process, allowing you to log your trips easily. Many apps automatically calculate ranges and categorize journeys, saving you time and lowering errors. In addition, maintaining sustaining documents, such as invoices for relevant expenditures, reinforces your instance for reductions.

It's necessary to be regular in taping your gas mileage. Inevitably, accurate and well organized gas mileage documents are crucial to maximizing your reductions, guaranteeing you take complete advantage of the possible tax obligation advantages offered to you as a company vehicle driver.

Typical Errors to Prevent

Preserving thorough records is a substantial action towards making best use of mileage deductions, but it's equally crucial to be familiar with typical blunders that can threaten these efforts. One prevalent mistake is failing to record all journeys precisely. Also minor business-related journeys can accumulate, so disregarding to videotape them can lead to considerable shed deductions.

An additional blunder is not differentiating in between individual and organization gas mileage. Clear classification is vital; mixing these two can trigger audits and result in penalties. Furthermore, some individuals forget to maintain sustaining papers, such as receipts for relevant costs, which can further confirm insurance claims.

Inconsistent tracking approaches additionally posture a challenge. Depending on memory or occasional log entrances can lead to mistakes. Utilizing a mileage tracker app makes certain regular and trustworthy records (best mileage tracker app). Lastly, forgeting IRS standards can jeopardize your insurance claims. Familiarize yourself with the most up to date policies concerning gas mileage reductions to avoid unintended errors.

Verdict

In verdict, effective gas mileage monitoring is necessary for maximizing tax deductions. Using a reliable gas mileage tracker streamlines the process of videotaping business-related trips, ensuring exact documentation.

Report this page